IR BLOG

Introducing Sampo’s business areas: Private Nordic

Sampo reports its financial performance under four segments based on its operational business areas: Private Nordic, Private UK, Nordic Commercial and Nordic Industrial. In this blog series, we will introduce all our segments. First up is Private Nordic.

Private Nordic is the Group’s largest segment and at the core of its value creation. In 2024, Private Nordic reported insurance revenue of EUR 3.7 billion, representing 44 per cent of the Group’s total. In total, Sampo serves around 3.7 million households in Sweden, Denmark, Norway, and Finland. The daily business is carried through the Group’s main customer brand, If, and other brands including Topdanmark and various white-label partnerships.

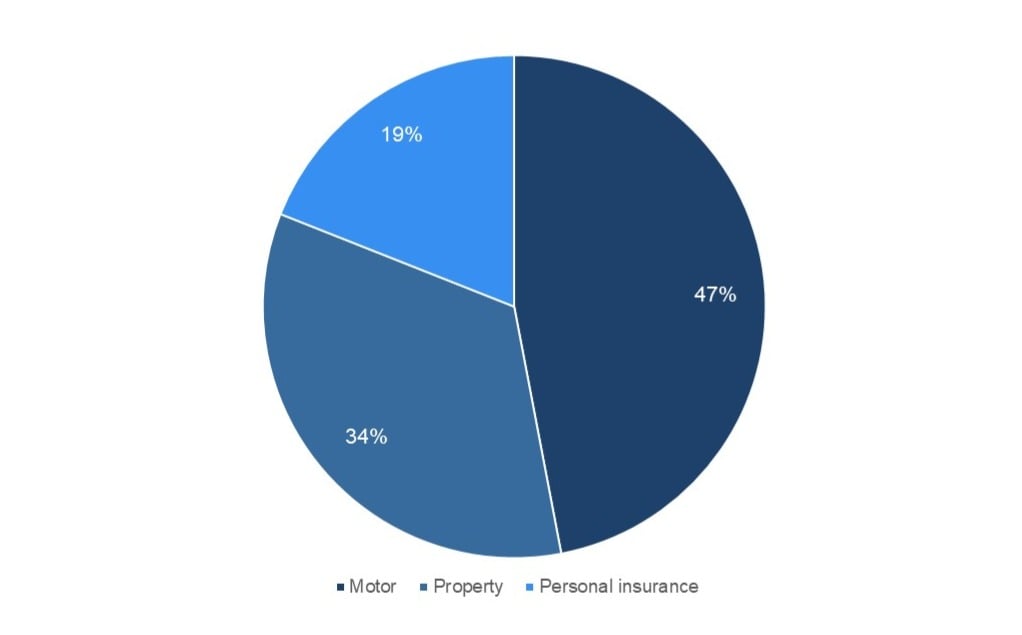

In terms of product mix, motor insurance is the largest product line within the segment, representing almost half of the insurance revenue. In fact, Sampo was one of the first companies to offer motor insurance in Finland in the 1920s. Since then, motor insurance has been our key products and today Sampo is a clear market leader with around 24 per cent market share in the Nordics. Sampo’s position is exceptionally strong in new cars, particularly in Sweden, where we have over 70 per cent market share in certain car brands through our long partnerships with car manufacturers.

Insurance revenue mix by product line (2024)

Operational ambitions

In its Capital Markets Day in 2024, Sampo announced a set of financial targets for 2024-2026 backed by operational ambitions in different segments. For Nordic Private, there are 3 externally communicated ambitions. In addition, 2 ambitions for the total Nordic business are primarily driven by the development in Nordic Private.

- Private Nordic, Customer retention: 89% or higher

- Private Nordic, GWP growth in property: >5% (period average)

- Private Nordic, Digital sales: >175 EURm by 2026 (updated from 160 EURm in Q1/2025)

- Total Nordics, GWP growth in personal insurance: >7.5% (period average)

- Total Nordics, online reported claims: >70% by 2026

Customer retention measures the share of households that renew their insurance policies each year. It’s undoubtedly one of the most important key figures for both top-line and underwriting performance. High retention means stable and predictable premium development with attractive cross-selling opportunities as well as better underwriting margins, since retaining existing customers is far more cost efficient than acquiring new ones due to marketing and distribution costs. In addition, a stable customer base leads to a balanced and predictable risk pool, whereas a sudden churn can distort risk assessment and pricing models.

However, achieving a high retention is not an easy task. It requires superior customer service, from competitive pricing to easy-to-use digital services and fast and fair claims handling. This is exactly where Sampo is at its best, which has reflected to the retention rate being high and stable in the 89-90 per cent range in the past years.

Private property, particularly home insurances, is one of the areas where the group sees attractive growth opportunities. These are supported by an extensive digital offering, broad distribution mix and new partnerships. Even though the development in the Nordic housing market has been somewhat sluggish recently due to higher interest rates and dampened consumer confidence, Sampo’s growth in property has been in line with its ambition, with 6 per cent growth in 2024 and in the first half of 2025 as well.

Another attractive growth area within the segment is personal insurance, including e.g. accident and health insurances. As the pressure on public healthcare system has grown year after year, there’s increasing demand for supplemental private healthcare. Sampo has an operational ambition to grow the personal insurance product line over 7.5 per cent on average across the Nordic segments. Within Nordic Private, personal insurance saw 11 per cent growth in 2024 and the first half of 2025.

When it comes to sales, our digital platforms are the most important distribution channel with over 50 per cent of new sales originating from digital channels. Yet, there is still plenty room to grow, particularly in Denmark, where the rate of digitalisation within P&C insurance has been lagging behind other Nordic countries. In 2024, we saw 10 per cent growth in digital sales, accelerating to 12 per cent in the first half of 2025. The performance is well in line with our ambition to achieve over EUR 175 million of digital sales by the end of 2026.

While our digital platforms provide attractive growth opportunities, sales is just one part of our digital customer engine that enables best-in-class customer service. In the event of damage, it’s of paramount importance that the claims handling process works flawlessly. Our ambition is that over 70 per cent of claims will be reported online across the Nordic segments by the end of 2026. Using our digital platforms for reporting claims translates to faster claims handling processes and higher customer satisfaction but also improved cost efficiency. Claims handling is one of the areas where we are increasingly using artificial intelligence, for example in assessing repair costs for vehicle damages. In Nordic Private (excl. Topdanmark), already 64 per cent of claims were reported online in the first half of 2025.

Underwriting result growth through top-line performance

Being the largest segment within the Group, Nordic Private has been a key contributor to Sampo’s underwriting result growth. The performance has been supported by organic top-line growth.

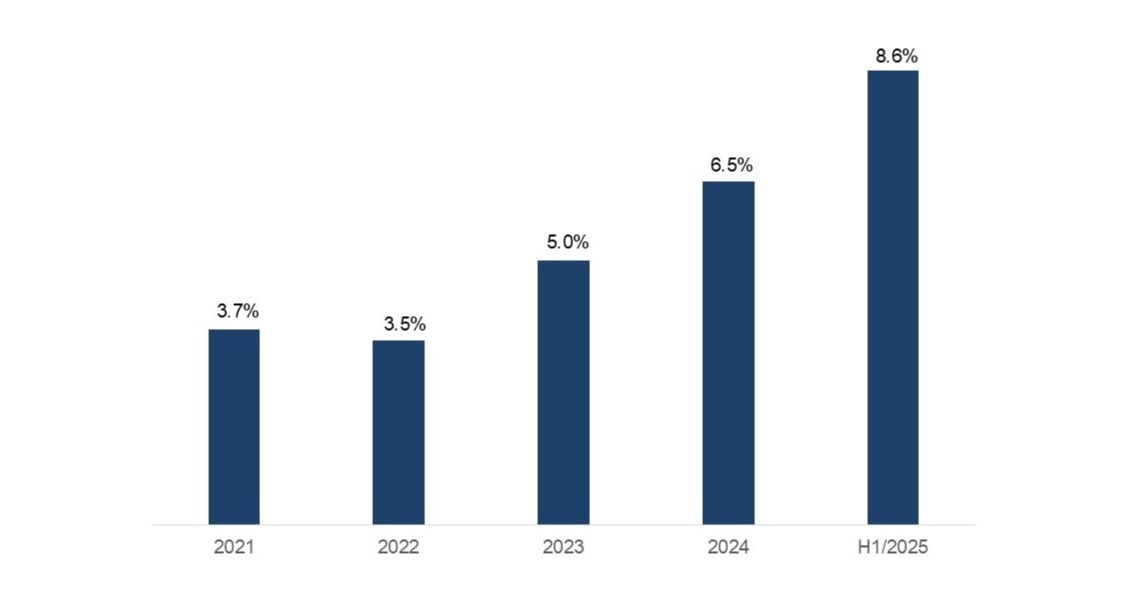

Since 2021, the segment has seen 5.5 per cent top-line growth on average, with accelerating performance lately. In the first half of 2025, we achieved 8.6 per cent growth. This was supported by high and stable retention, price action to mitigate claims inflation as well as positive development in both number of customers and objects insured.

Like-for-like GWP growth (2021-H1/2025)

2021-2024 excluding Topdanmark

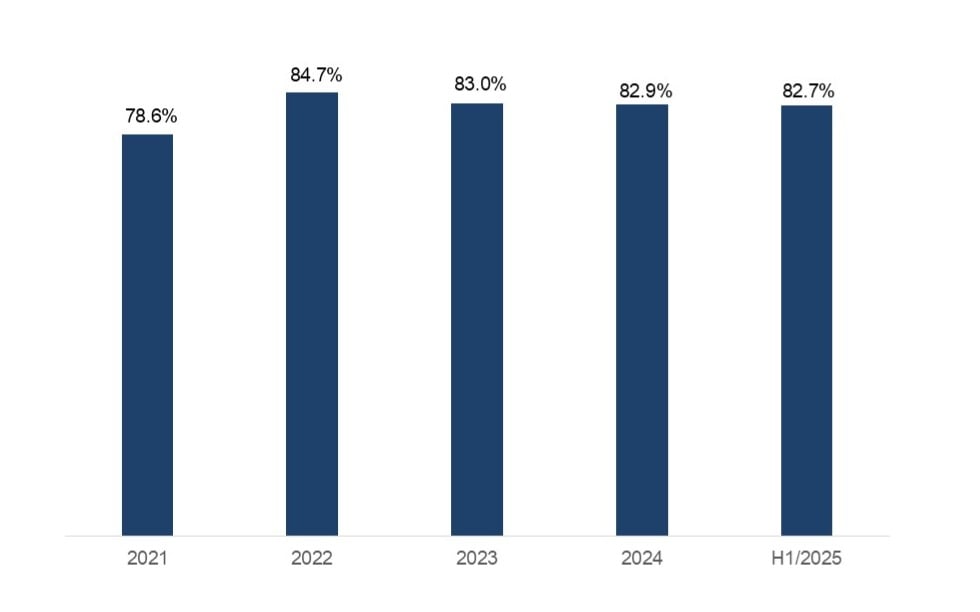

Thanks to the scale benefits and higher use of digital solutions, Private Nordic enjoys higher underwriting margins than our Nordic corporate segments, translating to lower combined ratios. In addition, the combined ratio volatility is usually lower as corporate businesses are exposed to stochastic large claims. However, weather conditions can play a big role in Private Nordic, particularly in the winter quarters (Q1 and Q4). For example, Q1/2025 saw very benign Nordic winter conditions, whereas the Q1/2024 comparison period witnessed the most challenging winter in 10 years. This led to a material 4.6 percentage points swing in the combined ratio between the periods.

Combined ratio (2021-H1/2025)

2021-2022 excluding Topdanmark

Combined with our disciplined underwriting and consistent improvements in cost efficiency, the robust top-line growth in Private Nordic has translated into attractive underwriting result growth. In 2024, the segment saw 6 per cent growth and in the first half of 2025, the growth came in at 24 per cent, although with the help of favourable claims environment due to benign weather conditions.

To sum up, Private Nordic is in the centre of Sampo’s value creation. As we continue to leverage our digital capabilities and capitalise growth opportunities, without forgetting underwriting discipline, shareholders can expect Private Nordic to deliver stable and growing contribution to the Group’s total earnings over time.

In the next blog entry, we focus on Private UK, the fastest-growing segment of the Group.