IR BLOG

Pre-Q1 Q&A

In this blog entry, we address questions we have received from investors and analysts during the first quarter.

Why did Sampo decide to launch a new buyback programme straight after the previous one and before the AGM in May?

The buyback was launched to return excess capital to shareholders, in line with our commitment to capital discipline. Sampo Group’s solvency balance sheet remained robust in the first quarter.

What was the COVID-19 situation like in Q1?

In January, there were still some restriction measures in place but in February and March general activity levels were more or less normal.

What were the weather conditions like in Q1 in the Nordics and the UK?

The Nordic region was affected by winter storms typical for the season, and in Finland the winter has been more snowy than usual. Temperatures have been in the normal range.

Like in the Nordics, the winter quarters (Q1 and Q4) in the UK tend to see relatively higher levels of motor and property insurance claims than the summer quarters (Q2 and Q3). In Q1 2022, the UK has been affected by a number of storm events.

How is the increase in inflation affecting Sampo’s P&C operations?

As stated with FY 2021 results, our Nordic business was not materially impacted by the increased rate of inflation in 2021, as was relatively brief and contained. Overall claims inflation across If’s operations stood at around 3 per cent at the end of 2021. In the UK, we highlighted high single digit inflation in the severity of motor insurance claims with our FY 2021 and we note that a number of our peers have made similar, or more cautious, comments recently.

A potential prolonged period of broadly based inflation, including wage inflation, would likely lead to increased claims inflation across all our geographies. Hence, we are monitoring the situation carefully and taking a very disciplined approach to pricing.

How has the new car sales developed in the Nordics?

The weak trend seen in Q4/2021 continued in January-February with new registrations declining in all countries, most notably in Finland and Norway.

How did the volatile capital markets develop during Q1 affect Sampo?

Sampo Group does not have any direct investments in Russia or Ukraine but we do hold a small amount of instruments issued by Nordic companies with exposure to the region. Since the start of the war, Sampo has reduced its ownership in such assets.

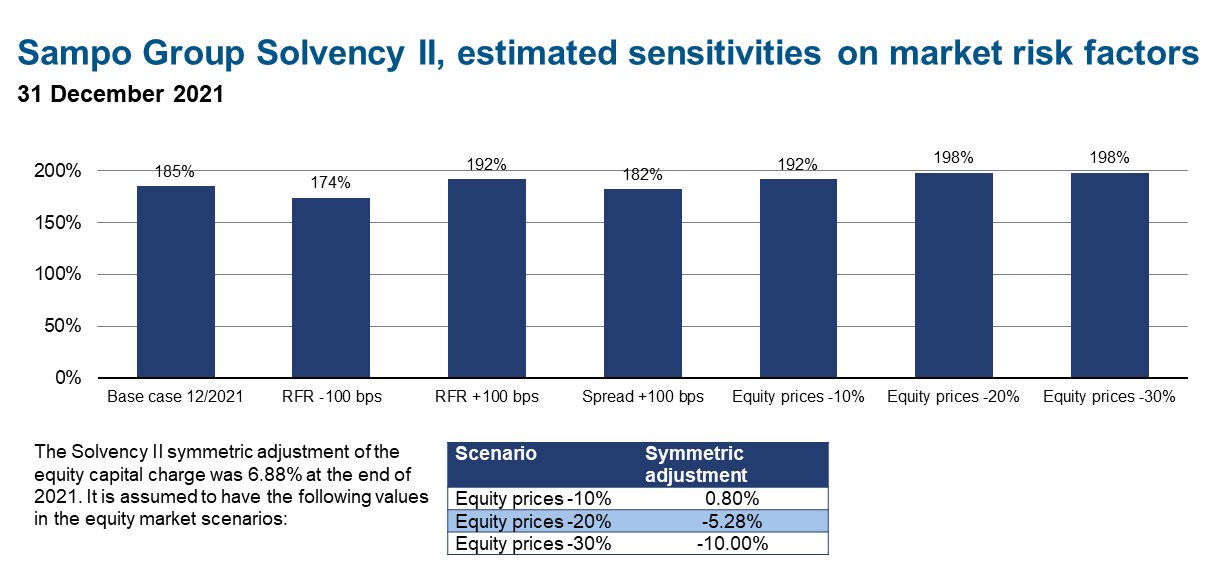

The increase in interest rates over the quarter is supportive of higher reinvestment rates and an increase in the solvency ratio (see sensitivities chart below). Although a reduction in equity markets has a negative economic impact on Sampo, the effect on solvency is substantially moderated by the symmetric adjustment (a countercyclical buffer applied to the capital charge for equities).

Was Nordea’s dividend booked in Sampo’s P&L for Q1?

Yes. Dividends are booked on the ex-dividend date, which for Nordea was 25 March 2022. Nordea’s dividend will be included in the Holding segment’s Net income from investments line. The share of Nordea’s result is no longer consolidated in Sampo’s P&L.