IR BLOG

Q&A - Investor questions

In this blog entry, we answer investors questions collected from different channels. Thank you for the good questions!

In January-March 2020, Sampo’s profit included an impairment of investment assets of EUR 191 million. What are the principals for these kind impairments?

Impairments are booked on a case-by-case basis and are based on accounting principles. The main rule is that impairment is assessed if significant or prolonged. In Sampo Group, e.g. for listed equities, the impairment is normally assessed to be significant if the fair value decreases below the average acquisition cost by 20 per cent and prolonged, when the fair value has been lower than the acquisition cost for over 12 months.

Value of an equity that has already been impaired cannot be increased later even if the fair value has recovered. However, values of fixed income investments can be increased to the original acquisition cost.

Who decides on the direct financial investments made from the parent company (e.g. the purchase and sale of Intrum shares)?

Investments are made in accordance with Sampo’s investment policy, and Patrick Lapveteläinen, Group Chief Investment Officer, is responsible for the decisions. Some, especially larger investments may require the Board’s approval.

Why did Sampo decide to sell its ownership in Intrum in February 2020?

Sampo does not usually comment on its individual financial investments. The sale of Intrum shares was a part of our normal investment operations.

If’s premiums increased 7.0 per cent in January-March. How much of the growth was explained by price increases and how much by new customers?

Roughly 60 per cent of growth came from price increases and 40 per cent from new customers. Premiums increased in all business areas and markets, but in Denmark and Norway, the growth was very strong.

Why did If’s combined ratio weaken so much in Norway in January-March from a year ago?

In Norway, the combined ratio was burdened by two very large claims. One of these was the fire in the parking garage at Stavanger Airport, which also gained some attention in the news headlines. If has limited its risk in individual large claims to approximately EUR 25 million through re-insurance.

How does inflation affect If’s business?

Very high inflation would create pressure on profitability as the increase in claims costs cannot be passed on to insurance prices between contract periods. So-called “normal” inflation does not have a large impact on business.

Does Sampo favor certain sectors or geographical areas in its investments?

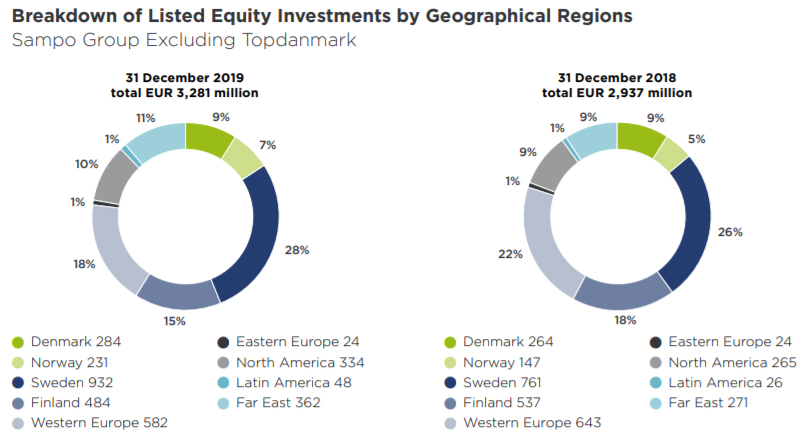

Geographically we prefer the Nordic countries, where we know the markets, companies and people. Other main principle is that we like to keep our investments and technical reserves in substantially the same currency in order to avoid extra currency risk.

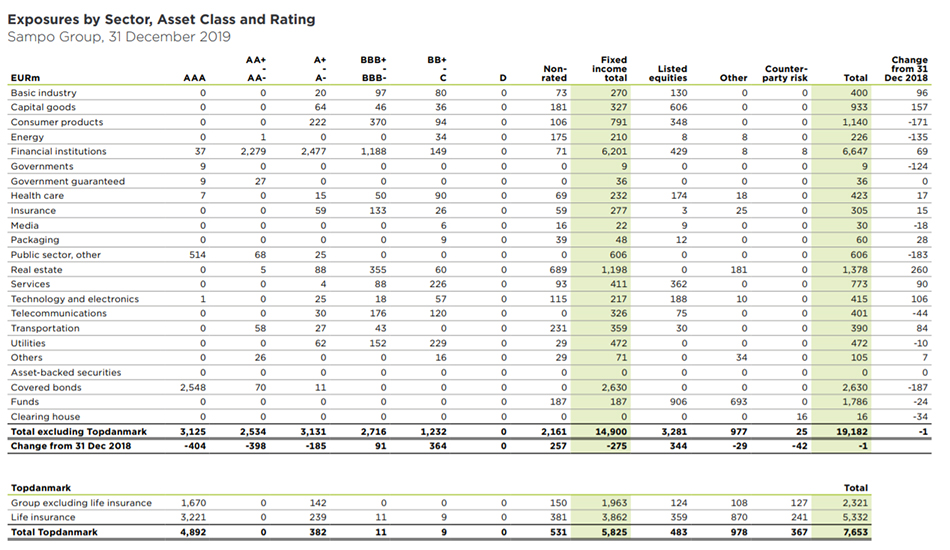

The Group’s investments by sectors and equities by geographical areas are described in the risk management report.

Has the coronavirus crisis affected Sampo’s investment policy? Has Sampo’s risk appetite increased or decreased during the crisis?

Sampo is a conservative investor and thus careful. We monitor the situation. No major allocation changes have been made.

Some investors feel betrayed as Sampo cut its dividend twice during the past year. How is Sampo going to regain their trust?

Investors’ trust can be earned sustainably only through deeds, not words. Sampo’s objective is to create shareholder value and success in this will play a crucial role in investor confidence.

In your view, how Sampo succeeded in its communication regarding the dividend during the past year?

There’s always room for improvement and, in retrospect, it is easy to see what could have been done differently. However, it is good to remember that all decisions and comments are always based on the best available information.

Has Sampo considered paying dividends quarterly?

There have been discussions about it every now and then. Such change would be decided by the Annual General Meeting and it would be good if the proposal came from the shareholders.

Would it be time for Sampo to sell Nordea?

As we stated many times, all of Sampo’s businesses and investments are for sale if the price is right. However, It is noteworthy that the sale of a nearly 20 per cent ownership in the largest bank in the Nordics cannot be conducted simply by pressing the sell button.

In autumn 2019, Nordea published its new financial targets for 2022. We consider the first steps encouraging and we believe that Nordea will achieve these targets. It is reasonable to expect that the success in the turnaround will also be reflected in Nordea’s share price.

Electric cars are becoming more and more common. In addition, cars will become more autonomous in the future. How these trends will affect insurance business?

Patrik Duraj, If’s Project Manager, Corporate Control & Strategy, answers this question.

“The automotive industry is presently undergoing structural change, driven by a long-term shift towards a more convenient, safer and cleaner mobility future. Two of the key technological trends fueling this transformation is vehicle autonomy and electrification, which we will hereby explore in more detail.

The term ‘autonomous vehicles’ emerged into the mainstream after the US military’s Defense Advanced Research Projects Agency in the early 2000’s showcased how new sensors, connectivity and computing technology could be merged to enable self-driving or even driverless vehicles. The trials induced the private sector to enter the race, most famously Google’s self-driving car project (now: Waymo) in 2008. The initial technological leap spurred aggressive deployment timelines, suggesting widespread deployment in just under five years – an outlook which since has been modified as the broader scope and complexity of the problem has been understood. Increasingly non-technological factors, namely ethical issues, costs, new insights on human-machine interaction, liability and legal obstacles has further prolonged development. Today, the leading players foresee a more gradual roll-out of self-driving functions, and signal that widespread adaptation of full self-driving systems (i.e. Level 5, according to SAE J3016) is likely still decades away.

Nevertheless, Advanced Driver Assistance Systems (ADAS) have gradually trickled down to vehicles available to consumers. Already today the most advanced vehicles are able to accelerate, change gears, steer and break under predefined conditions. This provides insights on how the computerization of vehicles influence driving behavior and risk, under real-life traffic scenarios. On the one hand, systems may be effective in limiting certain accidents. On the other hand, new accidents emerge from lacking user understanding of the systems’ capability, user error or sensor malfunction. Furthermore repair of even trivial accidents has increasingly become costly due to exposed expensive sensory equipment and evolving vehicle design.

Over the recent years, the push for electrification has overshadowed most of the other trends in the automotive industry. With the help from new lithium-ion batteries Tesla redefined the electric vehicle formula, showing how Electric Vehicles (EVs) could match fossil fueled cars on performance and luxury. Despite facing ever more stringent emission regulations, such as EU’s 2019/631, high battery costs proved prohibitive for most automakers. However, the Dieselgate-scandal fundamentally altered the narrative, as the targets were proven to no longer be achievable with fossil fuel drivetrains alone. As a consequence, most major OEMs are presently heavily focused on electrifying their line-ups, with disruptive implications on the automotive value chain as a whole.

One of Ifs home markets, Norway, has been a leader in electromobility, after introducing special incentives already in the late 1990s. Norway therefore is today by far the most electrified car market in the world per capita, with 42% of all new cars delivered in 2019 being fully electrified and even 9,3% of the total car stock being fully electrified. This provides If with an unique insight into how electromobility affects risk. On the one hand, electric vehicles induce new driving behavior, be it if you aim to drive efficiently (‘hypermile’) or enjoy the performance embedded in the vehicle (e.g. 0-100 in 2,5 seconds). On the other hand, electric vehicles diverge from traditional vehicles in construction, for example through the use of exotic materials (e.g. aluminum, carbon) or parts (e.g. batteries, electromotors, sensors), which affect repairability, repair methods and lead times.

As with fossil fuel equivalents, there are differences among both models and users, calling for close-knit risk models. Rooted in our Best In Risk culture, If has continuously evolved its tariffs and claim processes to accommodate the shift towards green mobility, and is already distributing the insights gathered in Norway to prepare for more electrification in the rest of the Nordic markets.

As an end-note, it is important to highlight how the long-term trends are constantly moderated by the industry’s need to meet short-term obligations. Already prior to Covid-19, industry headlines were dominated by stagnating global demand and profitability pressures. These pushed some OEMs into cost-cutting mode even prior to Covid-19, with “moonshot” innovation projects typically being the easiest to scale back on. Although still early to conclude, it seems evident that timelines could be affected as the long-term consequences from the supply- and demand side disruptions caused from the ongoing pandemic are made clear.”

What are Sampo’s largest equity investments after Nordea? Which have performed best?

At the end of 2019, the Group’s largest listed equity investments were Intrum (EUR 184 million), Volvo (134), Nobia (122), Norwegian Finans Holding (114) and Asiakastieto (92). Of these, Intrum was sold in February 2020 with a profit of approximately EUR 30 million.

In addition, Sampo has invested EUR 284 million in Saxo Bank, EUR 230 million in Nets through a private equity fund, and EUR 245 million in Nordax, which is an associated company.

Sampo will not report the performance of its individual investments.

In what situation and at what price would Sampo buy its own shares?

Share buybacks are decided by the Board, which is traditionally authorized by the AGM to buy a maximum of 50 million own shares. However, Sampo’s primary method of profit distribution, also preferred by the shareholders, is paying dividends.

Why have Sampo’s insiders hardly bought any shares recently?

Naturally, we do not comment on the personal investments of the company employees or board members.

Has Sampo’s solvency been a limiting factor in seizing opportunities during the past corona-related market turmoil? How could Sampo be better positioned for similar events in the future?

Last year, Sampo’s solvency decreased below our comfort zone, but after the issuance of the hybrid loan and the extra dividend in the form of Nordea shares, solvency returned to a solid level, which allows enough room for our investment activities. During the market turmoil, our solvency was at a strong level and was not a limiting factor.

For possible larger mergers and acquisitions, Sampo can back its solvency for example by issuing more hybrid capital. However, it is worth noticing that larger-scale moves require lots of time and planning. Thus, it’s difficult to take the advantage of these kind short-term dips.

What are Sampo’s key growth drivers in the coming years?

We answered this questions on our IR Blog on 17 December 2019.

“Insurance business is rather defensive and steady and one should not expect any rapid growth leaps. In P&C insurance, premiums can be expected to grow roughly at the same pace as GDP. However, If’s growth has been exceptionally strong recently, partly due to the favorable competitive environment in the Nordics. Low interest rates make it difficult to achieve good investment returns, which has forced all insurance companies to focus on technical profitability. This has reduced the aggressive price competition, which has positively reflected in If’s premium and customer volume growth.

In life insurance, the premium growth can be expected to be faster than the GDP growth. For the coming years, one key growth driver is the increasing importance of personal savings and financial safety net as unfavorable demographic trend create pressure on the public social security and pension system.

In the short-term, the biggest single profit potential relates to Nordea’s new business plan and targets.”

Could If seek growth from the healthcare sector?

If has no such plans at the moment and providing healthcare services is not within the company’s core competence.

Nordea will refrain from paying dividend at least until 1 October 2020 as the ECB recommends. If Nordea decides to pay the dividend after that, what will Sampo do with its share?

Sampo has no plans for the dividend it possibly receives from Nordea later this year.

Why is Sampo’s dividend policy so different (inconsistent according to the questioner, referring the decision to cut the dividend) than, for example, many American companies that have been increasing dividends every year for decades?

The dividend policy is decided by the Board elected by the AGM. Sampo’s shareholders have traditionally wanted to receive stable and high dividend, which is why the dividend payout ratio has been relatively high. Due to the high payout ratio, the dividend is more susceptible to significant changes, such as the change in Nordea’s dividend policy last year.

Some analysts have argued that there’s a “conglomerate discount” in Sampo’s share price, i.e. the share trades below Sampo’s sum of parts mainly due to Nordea. Does Sampo acknowledge such a discount and is it in the interest of shareholders? By what means could Sampo resolve the current situation?

Naturally, we do not comment on the valuation of our share, although Nordea-related questions have played a key role over the past couple of years, and that cannot be denied.

Sampo’s objective is to create shareholders’ value through its profitable businesses, investments and potential M&As. It’s reasonable to assume that in the longer-term, the valuation and share price will reflect our success in this. The fact is that Nordea’s success in achieving its new financial targets has a key role in creating shareholders value.