IR BLOG

Russia and Ukraine – Q&A

In this blog, we address questions we have received from investors and analysts about the war in Ukraine and its potential effects on Sampo Group.

Does Sampo Group have business operations in Russia or Ukraine?

The Group does not have any business operations in Russia or Ukraine. Sampo’s subsidiaries operate in the Nordics, in the Baltics and in the UK.

The Group have employees with background and ties to Russia and Ukraine that we support in these difficult and sad times.

Does If have any underwriting exposure to Russia or Ukraine?

If’s underwriting exposure to Russia and Ukraine is very limited and mainly within Business Area Industrial. If monitors the situation closely and has taken action to minimise the risks.

In its largest business area, BA Private, If does not have any material underwriting exposure to Russia or Ukraine.

However, rising energy and raw material prices, supply chain shortages and exchange rate fluctuations could be reflected in the claims inflation.

How will the changing economic outlook in Europe affect Sampo Group?

P&C insurance is stable and defensive business by nature, and not directly linked to short-term fluctuations in economic output or commodity prices. However, longer-term economic developments, could affect the demand and supply of P&C insurance. Of the Group’s core markets, the Baltics and Finland with close trade relations with Russia are could be directly more affected than other countries.

Does Sampo Group have investments in Russia or Ukraine?

The Group has no direct equity or fixed income investments in Russia or Ukraine. However, the Group does hold investments worth of double-digit million euros with material Russia/Ukraine exposures, such as shares in listed Nordic companies with Russian/Ukrainian operations.

How does the general market turbulence affect Sampo Group’s investments?

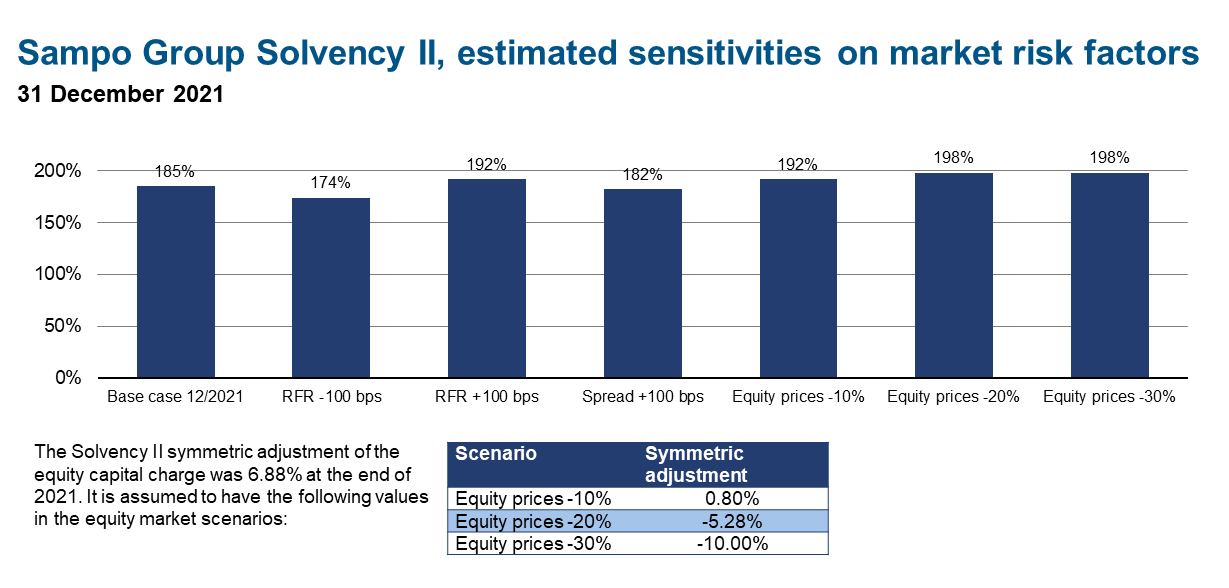

The market turbulence naturally has an impact on Sampo’s investment portfolio. However, the Group’s solvency (185% at the end of 2021) and liquidity positions are strong. In addition, the symmetric adjustment used in Solvency II calculation will absorb the impact from falling equity prices in the short-term, as shown in the sensitivity chart below.