History

The story of Sampo began in 1909. This brief history of Sampo encapsulates all of the relevant milestones of Sampo Group - from the early years prior to Finland’s independence right through to the present day.

An industrializing Finnish society and a growing economy called for new types of insurance cover. Founded in 1909, Sampo offered a new line for the insurance sector by providing multiple lines of insurance rather than just a single one.

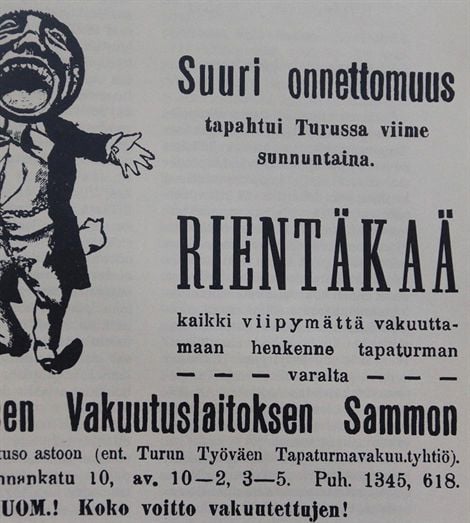

The first print advertisement by Sampo was published in the Uusi Aura newspaper following a disastrous tramway accident.

16

Sampo employed 16 people at the end of its first year.

The Sampo insurance company started out in offices in a Neo-Renaissance style building. This stone structure in central Turku (southwestern Finland) had been completed in 1898. Two other Turku-based insurance companies – Fennia and the reinsurance company Verdandi – had their offices in the same building. The companies shared a visiting address where clients were able to purchase all types of insurance policies available from the portfolios of these companies.

Sampo came about following years of strong industrialization and the need for insurance that followed an economic boom. For example, a law was passed in 1895 requiring industrial workers to be insured against the risk of unsafe work conditions.

Sampo started out as something of a unique newcomer in the Finnish insurance field. This was because most insurance companies at the start of the 20th century only offered a single line of insurance. Therefore, a number of businessmen in Turku came up with the idea of centralizing different lines of insurance under the same roof so as to better serve their clientele. Sampo was founded under this principle.

Its unorthodox business approach meant that Sampo was initially met with scepticism. The company was called a chameleon and a Jack of all trades, master of none. Nevertheless, the clientele soon appreciated this new approach and Sampo employed sixteen people by the end of its first year.

Being a Finnish company was a major advantage for Sampo. Whilst several international insurance companies had offices in Finland at the beginning of the 20th century, there was a clear wish for local entities. National identity was present in the company name: The Sampo is described as a magical artefact that brings good fortune in the national epic poetry Kalevala. Indeed, the Finnish romantic era was marked with many references to Kalevala. Another example of this is the life insurance company Kaleva that was founded in 1874.